The Ministry of Finance has adopted the Rulebook on Amendments to the Rulebook on Flat-Rate Taxation of Income from Independent Activity (“Official Gazette of Montenegro”, No. 118/24 dated 11.12.2024).

The Rulebook on Flat-Rate Taxation of Income from Independent Activity (“Official Gazette of the Republic of Montenegro”, No. 3/05 and “Official Gazette of Montenegro”, Nos. 80/08, 18/12, 12/14, 18/14, 25/16, and 8/22) has been amended as follows:

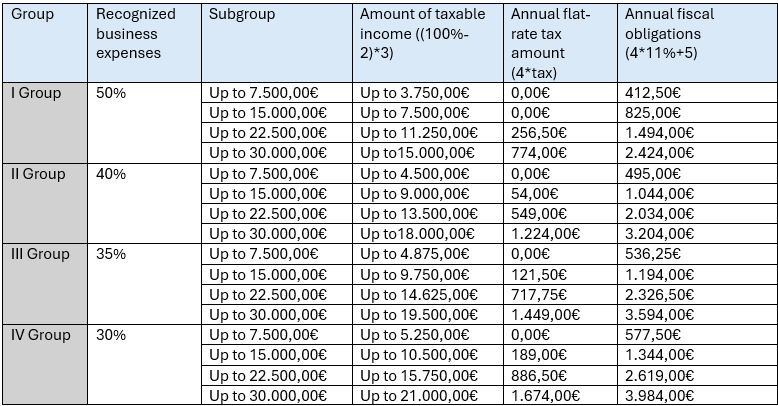

In Article 4, taxpayers are classified into four subgroups based on the amount of their actual or planned turnover, as follows:

- The first subgroup includes taxpayers whose turnover is up to €7,500;

- The second subgroup includes taxpayers whose turnover is up to €15,000;

- The third subgroup includes taxpayers whose turnover is up to €22,500;

- The fourth subgroup includes taxpayers whose turnover is up to €30,000.

In Article 5, the tax scale has been amended, and flat-rate taxation of income from independent activity will be applied according to the following tax scale:

A taxpayer must submit a request for flat-rate taxation of income from independent activity to the competent tax authority by the end of January in the year for which the tax is calculated (previously – by December 31 of the year preceding the year for which the tax is determined). In the case of starting the activity during the year, the request must be submitted within five days from the date of registration for conducting the activity.

This rulebook enters into force on the eighth day from the date of publication in the “Official Gazette of Montenegro” and will apply starting from January 1, 2025.

Other categories